National Petrochemical

& Refiners Association

1899 L Street, NW, Suite 1000

Washington, DC 20036

LW-01-137

A US MARKET SPACE ANALYSIS

OF GTL LUBRICANTS

By

Thomas F. Glenn

President

Petroleum Trends International, Inc.

Metuchen, NJ

Presented at the

NPRA

Lubricants & Waxes Meeting

November 8-9, 2001

Omni Houston Hotel

Houston, TX

Publication of this paper does not signify

that the contents necessarily reflect the opinions of the NPRA,

its officers, directors, members, or staff. NPRA claims no copyright

in this work. Requests for authorization to quote or use

the contents should be addressed directly to the author(s)

ABSTRACT

Gas-to-liquid (GTL) processing

provides a means to convert natural gas to such products as diesel

fuel, jet fuel, naphtha, base oil, wax, olefins, and alcohols. The

products produced by GTL are typically exceedingly clean. In addition,

they have very favorable manufacturing economics.

Lubricant base oils produced

by GTL processing are expected in the market in the 2005/2006 timeframe.

They are expected to initially enter the market by competing with

Group III and IV in the synthetic and synthetic-blend engine oil

market space. To a lesser extent, GTL base oils will also compete

with Group II+ as a correction fluid for Group I in 10W-30 formulations,

and as a workhorse against Group II+ in a growing market for 5W-30.

Rather than reducing the value of GTL by moving down the quality

continuum to Group I and II base oils, GTL base oils are expected

to reside in the high-end market space of Group II+, III, and IV

and be the beneficiaries of demand being pushed into this market

space by more stringent specifications.

In addition to GTL competing

in the emerging low viscosity passenger car motor oils markets,

it will also penetrate automotive driveline applications, premium

diesel engine oils, and high-end industrial lubricant applications

over the next five to eight years.

ACKNOWLEDGEMENTS

This paper is based on primary research conducted

by PetroTrends professional staff over the last three months. In

addition, it includes information derived from such secondary resources

as the Internet, and other public domain documentation. It is also

supplemented by information and insights provided by Nexant Chem

Systems. Nexant Chem Systems is a market research and consulting

firm. The firm recently completed a multiclient study focusing on

the manufacturing economics of GTL; Stranded Gas Utilization: Methane

Refineries of the Future."

PetroTrends would also like to acknowledge Syntroleum

for sharing its insights on some of the typical performance characteristics

for GTL base oils.

BACKGROUND

The technology of converting gas to liquids

(GTL), is based on the chemical process known as Fischer-Tropsch

(F•T) synthesis. The products produced by GTL include naphtha,

kerosene, jet and diesel fuels. In addition, GTL plants also produce

such specialty products as lubricant base oils, waxes, olefins,

and alcohols.

Interest in GTL has grown rapidly over the last

five years for several reasons. First, it provides a means to monetize

significantly more of the world’s natural gas reserves. These

reserves are estimated at over 14,000 TCF and hold the potential

to produce an equivalent of several hundred billion barrels of crude

oil. According to a study on GTL by Arthur D. Little, an estimated

“900 TCF of gas reserves are potentially suitable for monetization

by GTL technology.” A significant percentage of these reserves

are located in regions where there is little to no domestic demand

or too far from export markets to have much economic value.

Beyond the value of generating more equivalent

crude, however, GTL provides an economically attractive means to

produce fuels and specialty products far cleaner then those derived

from traditional crude oil processing. This is particularly important

in light of the increasingly stringent diesel fuel regulations coming

into play. In the US, for example, the United States Environmental

Protection Agency (EPA) will mandate a maximum of 15 parts per million

(ppm) sulfur level in diesel fuel in 2006. Even more restrictive

regulations are expected in Europe. In May of this year, the European

Commission proposed phasing in a 10 ppm limit on sulfur starting

in 2005. Similar requirements are also on the horizon in Japan and

other countries. These and other sulfur limits on the horizon will

be a significant challenge for refiners to meet when one considers

that the average level of sulfur in much of the diesel produced

today is roughly 300 to 350 ppm.

Diesel fuel produced by the GTL process is exceedingly

clean. It has no detectable levels of sulfur or aromatics. It also

has significantly higher cetane numbers than its crude oil derived

counterpart. Diesel produced by the GTL process can be used directly

as ultra high quality fuel, or as a blend component to boost the

performance of lower quality traditional diesel fuel. Similarly,

GTL processing also produces high quality (e.g. low sulfur, low

aromatic content) kerosene, jet fuel, naphtha and a number of such

specialty products as olefins, waxes, lubricant base oils, and others.

In addition to producing very high quality,

environmentally desirable “synthetic fuels, or synfuels”

and specialty products, GTL is also attracting a high degree of

interest because it provides a means to eliminate flaring and/or

reinjecting natural gas. Flaring is considered an environmental

issue and technology that eliminates it has value. Although somewhat

a longer-term issue, GTL also holds promise as a fuel source for

fuel cells. Fuel cells are expected to begin penetrating the internal

combustion (IC) engine market in roughly five years. The reformers

used in automotive fuel cell applications will have an appetite

for only the cleanest fuels, and GTL fuel can offer the desired

level of purity.

Driven by the opportunity to monitize natural

gas, and the other issues mentioned, interest in GTL has climbed

over the last few years. Currently there are 13 announced GTL projects

in the world. Taken together they have the potential to produce

an estimated 870 thousand barrels a day (TBD). The most active regions

in terms of number of plants are Qatar and Australia; three plants

have been announced for each. Egypt is also expected to be a hotbed

of GTL production with two announced plants with a combined capacity

estimated at 145 TBD, as shown in Table 1.

|

Table 1

ANNOUNCED GAS-TO-LIQUID PLANTS AS OF OCTOBER 2001

|

|

Location

|

|

|

Qatar

|

290

|

|

Egypt

|

145

|

|

Austrailia

|

115

|

|

Argentina

|

75

|

|

Trinidad

|

75

|

|

Indonesia

|

70

|

|

Iran

|

70

|

|

Nigeria

|

30

|

|

Total

|

870

|

Although much of the current interest in GTL

is tied to monitizing stranded gas to produce high quality diesel

fuel, it has also garnered interest due to its ability to generate

high quality specialty products, including lubricant base oil, waxes,

and olefins. In fact, there are two companies currently using Fischer-Tropsch

reactions to produce ‘synthetic” waxes. Schümann

Sasol operates a plant in South Africa and Shell operates a plant

in Bintulu Malaysia. The Shell plant uses the Fischer-Tropsch reaction

in the Shell Middle Distillate Synthesis (SMDS) process to convert

long-chain paraffinic feed into wax and other specialty products.

Both the products produced by Shell and Schümann Sasol have

very high purity and sharp hydrocarbon distributions. These products

are typically hard waxes with very high melting points (e.g. above

200°F)

Unlike petroleum wax, which is a mix of iso-

and normal paraffins, F-T wax is pure normal paraffin in the C20

to C60+ range. The characteristics of F-T waxes give them a significant

advantage over traditional petroleum waxes in such high-melt applications

as hot-melt adhesives, powdered coatings, inks, textiles, color

concentrates, and plastics. In addition, F-T waxes are also advancing

into the phase change materials (PCM) market. This includes such

applications as heating systems, food transportation, medical devices

and therapies, and other applications where the latent heat available

from phase change can be put to work. The global market in the high

melt space is roughly 80 to 90 million pounds, valued at roughly

$50 million, or about 1% of the total global wax demand. Although

F-T waxes offer clear advantages in some applications, in others

they are disadvantaged due to normal paraffin content and narrow

hydrocarbon distribution. This hydrocarbon profile does not currently

afford the same formulation and cut point flexibility found in petroleum

waxes and in a market as diverse and diffuse as the wax business,

formulation flexibility offers a distinct advantage to wax suppliers.

Opportunities in the wax market and how GTL

waxes might compete in this market space do weigh into the economics

of building plants. As a result, the outlook for GTL base oil is

also a function of the outlook for wax from these plants. This is

not to say that one could not justify the economics of a GTL base

oil plant without wax, but it does suggest that the economics of

a specialty GTL plant could be improved if high-value wax were part

of the product mix. As it does relate to the outlook for GTL base

oil production, additional background on GTL wax and how its market

space is likely to develop follows.

GTL wax. Most of the wax in the market today

is derived from base oil production. Although certainly a valued

product, technically it is a byproduct of classic solvent refining

– solvent dewaxing base oil production. Unfortunately, as a

byproduct of base oil production, the future of the petroleum wax

business is not in its own hands. Instead, it is in the hands of

the lube base oil unit, and times are changing.

Lubricant base oil manufacturers are feeling

pressure to incorporate catalytic dewaxing technology to meet increasingly

stringent base oil performance requirements. The catalytic dewaxing

process does not yield wax. Instead, the wax molecules are cracked

and isomerized into base oil, fuels, and other fractions. The impact

of this shift has been felt greatest in the North American market.

In the last five years, a major grassroots base oil plant was built

(Excel Paralubes) using catalytic dewaxing and three others replaced

existing solvent dewaxing technology with catalytic dewaxing. Others

are expected to follow. In addition, Petro-Canada added ISODEWAXING

capacity to its plant in late 1996. In addition to declines in wax

supply as a result of conversions from solvent dewaxing to catalytic

dewaxing, supply in North America has been further eroded by the

exits of several smaller base oil producers. These exits took wax

with them.

As discussed, how the market space for GTL base

oils develops will, in part, be influenced by the business opportunities

associated with the wax market and how these opportunities might

compete with other interests. GTL projects are considered to have

the potential to greatly increase wax supply because roughly 50%

of the yield from the syngas reactor is wax. The economics of world

scale GTL plants, however, will be driven by demand for low sulfur

diesel fuel, not wax and other specialty products.

Beyond the big picture economic realities of

a world scale GTL plant, a number of the major oil companies (those

with the resources to build a world scale GTL plant) would also

have to look across their businesses before heading into the wax

market. Many of the majors still produce wax from solvent dewaxing.

These companies will likely face the prospects of cannibalizing

their existing wax business should they decide to market wax from

a GTL plant. For some, this may prove to be a losing proposition

where every pound of wax moved into the market from the GTL plant

displaces a pound of wax they have already placed in the market

and produced from its solvent dewaxing unit.

The next likely new entrant into the F-T wax

supply pool would be a specialty products supplier with its eyes

on base oils, wax and other specialty GTL products. This would likely

be a producer with no ties to a conventional solvent-refining/ solvent-dewaxing

lube base oil plant. Such a player would not have to consider the

issue of cannibalization and could develop the high-melt wax market

competing aggressively in an effort to grab market share. Although

a specialty products GTL player could potentially do this, the value

of this effort is questionable since the high-melt point wax market

is fairly well balanced. It is also important to note that a new

entrant into the F-T wax market in the high-melt market space would

be competing with entrenched suppliers. They would also be competing

with PE wax suppliers. PE wax is already a formidable competitor

with F-T in the high-melt market space.

A new F-T wax producer could also decide to

target the large market spaces occupied by mid- and low- melts petroleum

waxes. This, however, is not a straightforward process. F-T wax

suppliers would likely find it necessary to fractionate the wax

because the C20 to C60 range of normal paraffins is too wide for

most applications. They may also find it necessary in many applications

to blend F-T wax with petroleum waxes in order to match performance

requirements with existing expectations. Even with the cost burden

of fractionation and blending, the cost structure for F-T wax could

prove an advantage. In assessing the magnitude of this advantage,

however, one would have to remain grounded in the fact that a decision

to compete in this market space is a decision to compete with a

large volume of byproduct coming from lubricant base oil production.

In summary, this means that the primary driver

for GTL plants today is high-quality, environmentally friendly diesel

fuel, not lubricant base oils, waxes, and other specialty products.

The catalysts used in a plant designed to produce GTL fuel and the

alpha value of its products do not readily lend themselves to base

oil production.

BASE OIL MARKET SPACE DEVELOPMENT

Few question if the market for GTL base oils

will develop. The primary questions asked today are when, where

and how will it develop, and who will develop it first. In addition,

there is a good deal of interest in the economics of these plants.

Insight into these and other questions starts with an understanding

of what GTL base oils are and what level of performance they offer.

GTL base oils are products synthesized by a

Fischer-Tropsch reaction. These base oils have no detectable levels

of sulfur, nitrogen, or aromatics, and they are water white. They

have a very narrow hydrocarbon distribution and excellent oxidation

stability characteristics. In addition, the lower viscosity products

(e.g. less than 4cSt) are typically biodegradable. GTL base oils

with viscosity grades used in automotive engine oil applications

(4.0 to 9.0 cSt) are expected to have a Viscosity Index in the range

of 140 to 155. By comparison, PAO has a VI of 120 to 138 for the

same viscosity range.

Another very important attribute of GTL base

oils and one that will shape its place in the market is its volatility.

GTL base oils reportedly have NOACK volatilities significantly lower

than API Group I, II/II+ and III base oils. A 4 cSt product, for

example, is reported to have a NOACK volatility several percentage

points below 10, as compared to a typical Group III with a NOACK

in the low- to mid- teens. These performance attributes position

GTL base oils well to compete with PAO and Group II+ and III in

the automotive lubricants market space. It also suggests that the

greatest value for GTL base oils will be realized in the automotive

lubricant viscosity grade ranges of 2 cSt to roughly 10 cSt and

that alpha values for specialty GTL product producers will likely

optimize on these grades.

GTL base oils also have excellent low temperature

properties. In fact, they appear to be only slightly disadvantaged

when compared to PAO’s cold crank viscosities. The pour point

of GTL base oils is, however, much closer to that of a Group II/III

than it is to a PAO. This can be addressed by the use of pour point

depressant and GTL base oils are reported to have excellent responsiveness

to methacrylate -based pour point depressants.

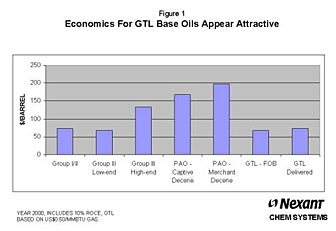

In addition to high quality, GTL base oils also

have very favorable manufacturing economics. According to a multiclient

study recently completed by Nextant Chem Systems, the manufacturing

costs for GTL delivered in the US market are comparable with that

of Group I, II, and II+. Even more importantly, ChemSystems' analysis

reveals that the economics for GTL are more favorable than that

of high VI Group III, as shown in Figure 1.

Considering the manufacturing

cost position of GTL base oils and its performance characteristics,

a starting point to begin modeling market space development for

GTL base oils is one that looks at how the market space for API

Group II and III developed. These products also entered the market

as high performance base oils with attractive manufacturing economics.

An analysis of how the market space for Group II and III base

oils developed is provided as a backdrop for how the market space

for GTL base oils might also develop

Group II and

III base oils. Group II and III base oils

are product definitions that have emerged over the last decade.

The American Petroleum Institute (API) developed the API base oil

group categories in an effort to differentiate the various levels

of base oils quality in the marketplace. In addition to placing

polyalphaolefin (PAO) in a class of its own (GROUP IV). The system

established three groups of paraffinic base oils. These groups were

based on saturates, sulfur, and viscosity index (VI), as shown in

Table 2.

|

Table 2

American Petroleum Institute Paraffinic Basestock Groups

|

|

|

Requirements

|

|

API Group

|

Sulfur, % wt.

|

Saturates, % wt.

|

Viscosity index

|

|

l

|

>0.03 and/or

|

<90

|

80-119

|

|

ll

|

£0.03 and

|

Ž90

|

80-119

|

|

lll

|

£0.03 and

|

Ž90

|

Ž120

|

|

lV - a

|

-

|

-

|

-

|

|

V - b

|

-

|

-

|

-

|

|

a - includes polyalphaolefin (PAO).

b - includes esters and other basestocks

not included in API Groups l through lV.

|

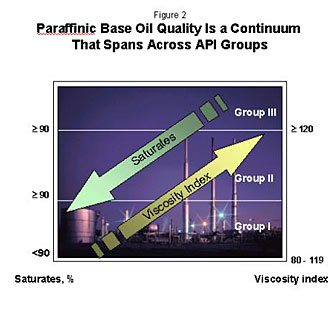

Group II and III base oils are generally considered

superior to Group I because they have a lower aromatic content and

higher viscosity index. Aromatic fractions tend to be more unstable

than saturated hydrocarbons, and as a result, Group II base oils

have superior thermal stability and resistance to oxidation over

Group I. In addition, as you move up the continuum from Group II

to III, you move from base oils with a minimum VI of 95 to Group

III base oils with minimum VI over 120. This higher VI, together

with aromaticity and other issues, makes Group III base oils an

ideal blend stock to meet the more stringent volatility requirements

in passenger car motor oil. In addition, it gives these base oils

an advantage in heavy-duty motor oil, and ATF.

Although the API Group classifications do provide

clear guidelines to differentiate conventional and unconventional

base oils, it is important to consider the differences between API

Groups as a quality continuum based primarily on saturates and VI,

as shown in Figure 2.

The importance of this continuum gave rise to

the “Group II+” designation. Although Group II+ is not

an official API definition; it emerged out of the need to describe

base oils with a meaningfully higher viscosity index than the 100

than is typical of most Group II base oils. Group II+ base oils

typically have VI in the range of 108 to 115. These base oils offer

performance advantages over Group II in some passenger car motor

oil applications, specifically related to balancing volatility with

low temperature viscometrics.

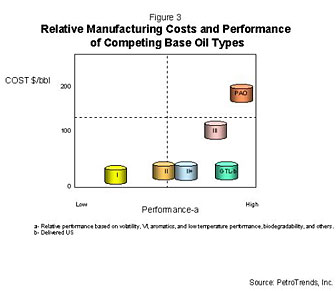

Where GTL base oils will fit in the API base

classification system has yet to be determined. Based on some of

the performance data currently being developed, however, it is believed

that GTL base oils would likely be handled in one of three ways.

One possibility is that another API group will be established to

accommodate it. Another possibility is that it will simply fall

into a Group III designation because it does, in fact, meet the

criteria for a Group III. Another possibility is that GTL base oils

will follow the path of Group II+. This is likely to result in a

market-place designation of Group III+. As shown in Figure 3, the

performance of GTL is considered nearly equal to Group III, however,

it could enjoy significantly lower manufacturing costs. The cost

and performance of GTL base oils suggest it will likely track a

market space development path similar to that of III, and to a lesser

extent, Group II+.

The market space for Group II+ and Group III

was developed on several fronts, including:

- Direct competition with PAO

- Low volatility base oil solution for 5W-xx

engine oils

- Blend stock/correction fluid for other base

oils

How the market space for Group III and II+

developed in each of these areas and how GTL market development

might follow it is discussed below:

Dirct competition with PAO. Group III base oils

are typically produced by incorporating isomerization of wax fractions

from the base oil into the overall process. The isomerization process

changes the geometry of wax molecules to structures with acceptable

low temperature performance characteristics (they don’t form

wax and solidify at cold temperatures). In addition, the isomerization

of wax can significantly boost the VI of the base oil. In fact,

if run under more severe conditions the VI of a paraffinic base

oil can be pushed up to a level that parallels that of PAO. Pushing

VI up does, however, come at the expense of yield. The high VI,

together with very low aromatic content of Group III, put it in

an excellent position to compete with PAO, and that is exactly what

it did when it entered the market.

PAO had enjoyed a nearly unrivaled position

as the “synthetic” base oil of choice in automotive and

industrial lubricant applications. It captured an estimated 2% of

the total lubricants market. Although PAO offered excellent oxidation

stability and unparalleled low temperature performance it had a

weakness that Group III exploited. Its weakness was manufacturing

cost. The cost to produce PAO was fairly well studied and many were

aware that the minimum costs to produce PAO were significantly higher

than that to produce Group III. It was also well known that although

Group III could beat PAO on a cost basis, PAO still had the virtually

exclusive right to bear the valued “synthetic” label,

and PAO could far outperform Group III in a cold crank simulator

(CCS). This advantage, however, virtually vanished overnight when

Castrol replaced PAO in its synthetic engine oil formulation with

extra high VI paraffinic base oil. This represented a significant

cost saving in the formulation. It also resulted in a challenge

from Mobil regarding the use of the term “synthetic” by

Castrol. The challenge was brought to the National Advertising Division

(NAD) of the Council of Better Business Bureaus (CBBB). On April

5, 1999 the NAD announced that Castrol North America could continue

to advertise its product as “synthetic” motor oil even

though Group III was being used. Group III now had the right to

wear the “synthetic” lubricants label. Many lubricant

manufacturers switched from PAO to Group III shortly after this

ruling was announced to take advantage of the reduced cost of the

“synthetic” base oil.

In addition to market opportunities as a replacement

for PAO in automotive applications, Group III has and will continue

to displace PAO in some industrial lubricant applications. Its leverage

in this space is, however, weaker than it is in automotive engine

oils. The automotive engine oil segment ascribes high value to the

term “synthetic.” The industrial segment places far less

value on the term “synthetic” and much more value on the

performance advantages they offer. Although the oxidation stability

of Group III is similar to PAO, PAO significantly outperforms Group

III in low temperature applications. As a result, market share capture

by Group III in the industrial lubricants space has come much more

slowly than in the automotive segment.

GTL base oils have an opportunity similar to

the one Group III capitalized on in the PAO market space. The primary

difference, however, is that it will now be competing with both

PAO and Group III. Group III only had PAO to contend with.

The challenge for GTL in this market space,

specifically in synthetic and synthetic-blend automotive applications,

will be cost. Formulators switched from PAO to Group III in automotive

engine oils due to the cost savings one could enjoy by blending

with Group III. Any switch from Group III to GTL would either have

to represent a relatively significant cost savings, and/or measurable

boost in performance. The performance advantages of GTL over Group

III will likely be found on several fronts. On one front, GTL will

promote the superiority of its volatility over that of Group III.

It is believed that GTL will also use additive responsiveness and

total formulation costs as a tool to capture market share from Group

III and PAO. GTL base oils may also provide “environmentally

friendly” solutions to the industrial lubricants market due

to its biodegradability and its absence of sulfur and aromatics.

Base oil solution for low volatility in passenger

car motor oil. In addition to going head to head with Group III

and PAO in the high performance segment of the automotive lubricants

business, GTL is expected to compete with Groups II+ and III with

a model similar to the one used by Group II, II+ and III to capture

market share from Group I in passenger car motor oil. It did so

by responding to OEM interests in fuel economy and the fact that

the use of lower viscosity engine oils can improve fuel economy.

The use of lower viscosity engine oils (e.g. 5W-30) did not, however,

come without concerns. In addition to the market’s reluctance

to embrace lower viscosity engine oil grades, technical hurdles

existed in regard to the ability of the engine oil to stay in grade

during use. Engine oil can thicken and come out of grade when subjected

to the high operating temperatures in an engine due to the light

end boiling off. This meant that although engine oil would yield

desirable fuel economy performance on an engine test stand, it did

not necessarily reflect what was actually delivered in service once

the oil is exposed to heat and aged in operation. In an effort to

address this issue, the International Lubricant Standardization

and Approval Committee (ILSAC) introduced volatility into its GF-2

standard in the mid-1990s.

The first iteration of GF-2 included a comparatively

stringent specification for volatility in multigrade passenger car

motor oil. It was tough, and the volatility of many of the base

oils on the market at that time did not offer the performance necessary

to meet GF-2. Base oil manufacturers had several alternatives. One

option was to narrow the cuts in an effort to compress the hydrocarbon

distribution in the base oils. This solution was considered relatively

costly because, although it would reduce volatility by effectively

cutting off light ends, it also cut off longer chained hydrocarbons

at the other end of the distillation curve. This approach placed

a significant penalty on yields and as a result, was costly. Another

option that could have been used to meet the first iteration of

GF-2 was to blend conventional paraffinic base oil with polyalphaolefin

(PAO). This too, was considered a costly solution because PAO was

over four times the price of conventional base oil. A third option

was to work with ILSAC and other industry stakeholders in an effort

to relax the specifications for volatility in GF-2 and give the

industry more time to prepare. The base oil industry argued that

it was not ready for such a restrictive specification. Agreement

was reached to relax the volatility specification for GF-2 and most

base oil manufacturers were then in a position to meet the requirements.

Most engine oils on the market at that time

did come in under the wire for the final version of GF-2. The process,

however, sent a clear message to the industry that volatility would

be revisited in the next passenger car motor oil specification (GF-3),

and that something other than “conventional” base oil

would likely be required in the near future for those interested

in competing in the automotive lubricants business.

Although most of the base oil in the US market

was “conventional” when GF-2 emerged, there was one exception;

Chevron. Chevron’s Richmond plant operates with manufacturing

schemes based on hydrocraking and wax isomerization, specifically

Chevron’s ISODEWAXINGÔ technology. Rather than removing

impurities with solvents and hydrotreating, this process uses a

hydrocracking process with special catalysts to literally break

the bonds of aromatics and saturate the remains of these and other

constituents in a high temperature, high-pressure atmosphere that

is rich in hydrogen. Unlike “conventional” solvent refining

where the aromatic content of the base oil is roughly 10%, hydrocracking

typically reduces the aromatic content of paraffnic base oils to

less than 1%. In addition, it typically produces a more refined

cut in terms of hydrocarbon distribution. These attributes, with

the catalytic dewaxing process that increases viscosity index, resulted

in base oils that could meet the more stringent volatility requirements

initially proposed in GF-2 and beyond.

Interestingly, although Group II base oils have

been in the North American market for close to 15 years and demonstrate

superior performance capabilities, they didn’t receive much

attention until about the last seven years. The primary reason was

limited supply. As discussed, there were only two producers in North

America when GF-2 emerged – Chevron and later Petro-Canada.

This changed, however, when Excel Paralubes (a joint venture between

Pennzoil and Conoco) built a grassroots Group II plant that came

on stream in 1997. The Excel plant increased supply of Group II

by nearly 20 TBD. This additional supply gave Group II the critical

mass necessary to help convince automotive OEMs that the lubricants

industry now had the technology in place required to meet more stringent

specifications around volatility. The new specification represented

a step change in PCMO volatility, as shown below in GF-3.

|

Table 3

NOACK Volatility

|

|

|

NOACK Volatility (a)

|

|

PASSENGER CAR MOTOR OIL

GRADE

|

GF-1

|

GF-2

|

GF-3

|

|

OW• and 5W•

multiviscosity grades

|

25

|

22

|

15

|

|

All other multiviscosity

grades

|

20

|

22

|

15

|

|

NOTE: (a) D-5800-99 standard test method

for evaporation loss of lubricating oils by the NOACK method.

|

This specification would clearly favor the use

of Group II and pull through demand based on technical need. In

fact, for some grades, the specifications virtually required the

use of Group II and II+. In addition, Group II was also showing

promise as value-added base oil in heavy-duty motor oil applications

and ATF. This too resulted in pull-through demand.

As discussed later in this paper, GTL base oils

likely will be the beneficiaries of the momentum in pull through

demand established by Groups II, II+, and III in automotive engine

oil applications.

BLEND STOCK/CORRECTION FLUID FOR OTHER

BASE OILS

Although base oil manufacturing is clearly shifting

from Group I to Group II in the US and Canada, Group I base oils

are expected to remain an important part of the supply pool. These

base oils are favored as the low cost workhorses for a wide range

of price sensitive industrial lubricant applications. Some lubricant

blenders use Group I because they have captive supply, others use

it because it aligns well with their product portfolios. In many

cases, blenders heavily reliant on Group I base oils will find it

necessary to bring in such high quality base oils as Groups II+,

III, and IV as a means to enhance the performance of the workhorse

Group I. An example of how a blender could use a Group II+ to enhance

the performance of a Group I can be seen in a 10W-30 PCMO formulation.

Although there are many ways to meet the volatility requirements

for GF-3 in a 10W-30, an economical option is to blend with roughly

70% Group I base oil, 10% Group II+, and additives.

GTL base oils are expected to compete with Group

II+, III, and IV as a blend stock to enhance the performance of

Group I base oils. Its ability to displace these competing stocks

is expected to be based primarily on performance and its impact

on total formulation costs.

GTL BASE OIL MARKET SPACE DEVELOPMENT

GTL base oils are positioned to track the footsteps

already established by Group II and II+ as the workhorse in some

multigrade engine oils and as a correction fluid in others. The

challenge for GTL base oils in the US, however, will be the relatively

sluggish market penetration of 5W-30. In addition, Group II and

II+ base oils have already established themselves as the solution

for 5W- and 10W-30 engine oils. This means that additives are well

on their way to being optimized, blenders are comfortable working

with these stocks, and product development costs have been invested.

Rather than potentially giving away value by

competing with Groups I and II base oil in the 10W-30 PCMO market

and others, a more likely scenario is one that allows GTL to maintain

its value by waiting for the direction of specifications to mature

the market into the market space currently occupied by Group III

and IV, and to a lesser extent Group II+. The direction of specification

has already moved a significant volume of base oil demand out of

the Group I space and into the Group II and II+ space in the US

market. Future specifications will continue to push demand through

the Group II and II+ space into the space occupied by Group III,

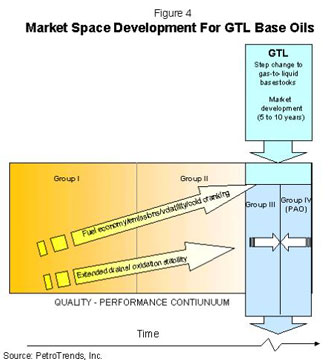

Group IV and GTL, as shown in Figure 4.

The challenge for GTL in this approach,

however, is that the market will take time to evolve into its space.

This evolution will be tied in a large way to market acceptance

of 5W- and 0W-xx engine oils. The most significant pull-through

demand for GTL base oils in PCMO will, however, likely be tied to

0W-xx. Meeting the volatility requirements in this grades is expected

to be attainable only with PAO and likely GTL. Although the low

temperature performance of GTL base oils could be an issue, data

exist to suggest that this issue can be overcome by GTL’s favorable

responsiveness to additives. It is also important to consider, however,

that even with OEMs promoting the use of 0W-xx, consumers have the

final say. If market acceptance of 5W-30 is any indication, consumers

are slow to accept lower viscosity grades even when OEMs recommend

them.

What this means is that GTL will not likely

be a significant demand event in the US for at least the next eight

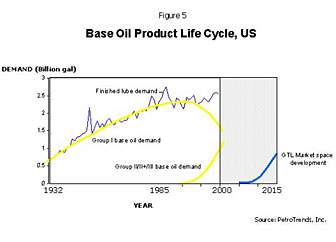

to ten years. From a product life-cycle perspective, we will likely

see GTL entering the supply pool in the 2005/2006 timeframe. If

one uses the GTL plant completion schedules currently tabled, the

supply build model of Group II/II+ and III, and the grade switching

rates of 5W-30 as a guide to model with, the introduction phase

of the GTL life cycle will likely begin in 2005 and take about five

years before it advances into the growth phase, as shown in Figure

5. Initially it will do so at the expense of Group III and IV base

oils by capturing market share in the synthetic and synthetic-blend

automotive lubricant market space. It will also penetrate the ATF

and automotive driveline market space at the same time. Market acceptance

of GTL is, however, expected to be modest during this introductory

phase of its life cycle due to a limited number of suppliers.

GTL is expected to transition into a growth

phase by capturing demand away from Group II, II+, III, and IV as

demand for 5W- and 0W-xx PCMO increases. As additional supply comes

on line it will give OEMs and blenders the assurances they need

that supply lines are adequate and secure. This will catalyze growth-phase

demand by moving it into a push-demand scenario similar to that

currently occurring with Group II base oils. Push marketing will

drive up demand for GTL in heavy-duty engine oil and industrial

high performance industrial applications.

GTL is also expected to capture significant

market share of the automotive driveline segments over this same

period due to fill-for-life initiatives.

It is also important to consider that although

GTL may not be a significant event in the US over the next eight

years, it will enjoy more aggressive growth in Europe and Asia.

The lubricants market in Europe is more mature than that in the

US and market acceptance of 5W- and 0W-xx is further along.

CONCLUSION

Although the primary focus

of gas-to-liquid (GTL) technology is currently on opportunities

in diesel fuels, base oils derived from this technology could also

be in place by 2005. Base oils produced by GTL processing are expected

to deliver quality superior to Group III and at very competitive

costs.

Base oils produced by GTL

processing are expected to initially enter the lubricants market

by competing with Group III and IV in the synthetic and synthetic-blend

engine oil market space. They will compete with these base oils

primarily on performance and secondarily on price and total formulation

costs. To a lesser extent, GTL base oils will also compete with

Group II+ in a growing market for 5W-30. Rather than reducing the

value of GTL by moving down the quality continuum to Group I and

II base oils, GTL base oils are expected to park themselves in the

high-end market space of Group II+, III, and IV and be the beneficiaries

of specification pushed demand into its space. This will occur by

increasingly stringent performance requirements and market acceptance

of 5W- and most importantly 0W-xx PCMO.

In addition to GTL competing

in the emerging low viscosity passenger car motor oils markets,

it will also penetrate automotive driveline applications, premium

diesel engine oils, high-end industrial lubricant applications,

and white oil applications over the next five to eight years. Adoption

of GTL base oils is expected to occur at a faster rate in Europe

than in the US due to the rate of market acceptance of 0W-xx engine

oils. In addition, GTL will penetrate the Asian market.

Copyright © Petroleum Trends International,

Inc. 2002

|